“OPEC+ is already struggling to keep pace with the current deal - even core OPEC members such as Saudi Arabia, UAE and Kuwait exported considerably less last month than in April,” he said. Even before the war in Ukraine, he said, oil producers were winding down investment in production as they pivoted towards renewable energy. The IEA predicts that global oil production, excluding Russia, should rise by more than 3 million barrels a day for the rest of this year, balancing out the impact of sanctions.īut Smith thinks this could be difficult to achieve. The Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, agreed on Thursday to pump an additional 648,000 barrels of crude a day into the global market in July and August - 200,000 more than planned - in a deal that included Russia. Russia shut off nearly 1 million barrels per day of oil output in April and this could reach about 3 million barrels per day during the latter half of 2022, according to the IEA. Last year, Russia, accounted for 14% of global oil supply, according to the International Energy Agency, and the West’s sanctions on Russia are already creating a significant gap in the market. But the silver bullet the world really needs to bring down prices - a lot more supply - is hard to come by. Governments can do a few things to ease prices, including offer fuel subsidies and capping prices at the pump. “A direct impact of this is the higher freight cost due to the longer-haul voyages, and in turn, delivered costs of the oil,” he said. Sourcing oil from more far-flung locations will keep prices high, Roslan Khasawneh, senior fuel oil analyst at Vortexa, an energy data firm, told CNN Business. According to Kpler data, imports of crude from Angola have tripled since the start of the war, while Brazilian and Iraqi volumes have risen by 50% and 40% respectively. Most EU countries now have six months to phase out imports of Russian crude, and eight months for all other oil products.įor now, Smith said, the bloc will likely continue to buy some oil from Russia, but it has been shopping around for alternate suppliers.

The European Union on Friday formally adopted its oil embargo, part of a sixth package of sanctions imposed on Moscow over its invasion of Ukraine.

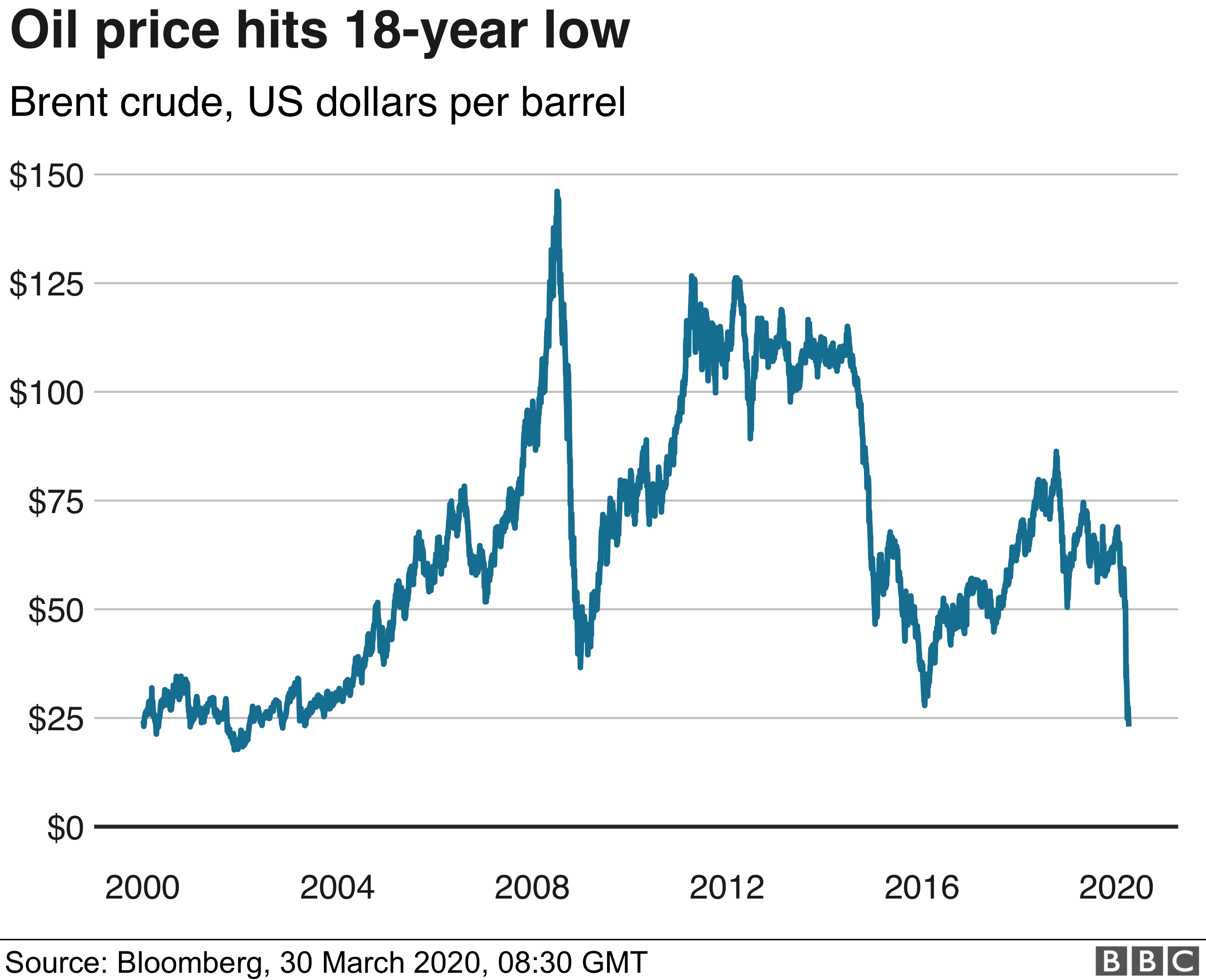

“The worry this time around is - because it is a supply side issue - that even if we were to head into a recession … we may not necessarily see prices come off at the pump substantially,” Smith said. “If Chinese demand comes roaring back after lockdowns and Russia continues to see production drop, then a retest of the high of $139 seen earlier in the year is not beyond the realms of possibility,” he said.Įven as soaring inflation and sluggish growth raise the specter of recession, global demand for oil is unlikely to fall enough to dent prices, as it did in 2008. Matt Smith, lead oil analyst for the Americas at Kpler, an analytics company, told CNN Business that “triple digit oil prices” are likely to stick around. The EU embargo and a recovery in demand in the world’s second biggest economy will keep them high.

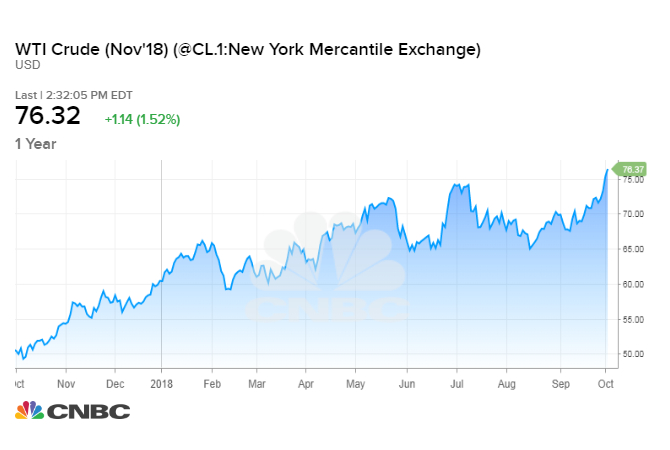

Prices have since fallen back slightly to around $117, largely because of expectations that OPEC will pump more oil, but not enough to ease the pain felt by consumers at the pump, or to tame rampant global inflation. The price of Brent crude, the global benchmark, shot up past $124 a barrel earlier this week - its highest level since early March - after the European Union announced it would slash 90% of its Russian oil imports by the end of this year.

#OIL PRICES TODAY MARKET WATCH DRIVERS#

Oil prices have roared back to about where they were in the early days of the Ukraine war, and there’s no prospect of significant relief for drivers and businesses any time soon.

0 kommentar(er)

0 kommentar(er)